Published on Tuesday November 30 2010

Namibia aims to build a nuclear power plant to fuel economic development in the world's fourth-largest uranium producer.

"It is the expressed decision of the Namibian government to seriously consider the development of nuclear power in order to complete the national energy mix and provide sufficient energy for our development," Mining Minister Isak Katali said yesterday.

"The uranium and nuclear energy policy to be developed will cover the entire nuclear-fuel cycle," Katali said at the country's first stakeholder meeting on plans for a policy on uranium mining and nuclear energy, convened with the help of Finland's nuclear authority.

The policy document and draft legislation were expected to be finalised by the middle of next year, said mining commissioner Erasmus Shivolo. "Nuclear waste will have to be stored in Namibia."

Finding a "convenient storage site" would be part of policy development.

Namibia has previously floated the idea of building a nuclear power plant by 2018 but analysts said it would be hard for it to finish a reactor by then, given the long time it takes to build a plant and the massive investment required.

The government first tabled plans for a nuclear plant in 2007.

Shivolo presented a rough outline of the new nuclear policy with sections on a nuclear-waste management fund, increasing black Namibians' participation in the uranium sector and limiting the use of the country's uranium to peaceful purposes.

Namibia produced 4626t of uranium last year, according to the World Nuclear Association. The government put a moratorium on issuing uranium exploration licences in 2007 because it did not have a nuclear policy.

Four companies hold uranium-mining licences, two mines are operational and two mines are under construction, including one being developed by French energy giant Areva, which plans to start production next year.

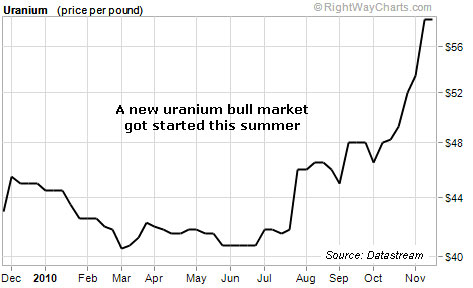

Namibia's uranium deposits have drawn increasing interest from France, Russia and other countries as global enthusiasm for nuclear power revives.

Namibia has no nuclear power of its own and relies on South Africa for about half its electricity.

Visit my other site Australian Uranium Investing

Australian Uranium News - Research

Australian Uranium News - Research